Tackling Digital Payment Fraud with Tap on Own Device

In the fast-paced world of digital payments, fraud is a constant and growing challenge. As eCommerce sales surge, so too does fraud, with the global market projected to see $343 billion in Card-Not-Present (CNP) fraud by 20271. The need for innovative, secure and scalable payment solutions has never been greater. Enter Tap on Own Device (ToOD), an advanced technology provided by Halo Dot that is poised to revolutionize how businesses handle digital transactions – driving security, enhancing the customer experience and reducing costs.

Understanding Transaction Types

Digital payments fall into two primary categories: Card Present (CP) and Card-Not-Present (CNP) transactions.

- Card Present Transactions (CP): These occur when a customer physically presents their card at the point of sale to the merchant, such as in a retail store. Because the cardholder and merchant are physically present, these transactions are typically more secure as the cardholders identity is assumed to be verified.

- Card Not Present Transactions (CNP): These occur when the customer is not physically present in the store in front of the merchant, meaning that there is no in-person verification of the cardholder’s identity, making them a target for fraud2.

A Global Surge in Card-Not-Present Fraud

Recent industry reports underscore the urgent need for better fraud prevention. CNP fraud is expected to exceed $343 billion by 2027¹, with regions like Asia, North America, and Latin America already showing alarming trends. In Asia, where 64% of global transactions take place, the cost of fraud is estimated at $4 per transaction. The UK has seen a 40% year-on-year increase in online fraud, and 85% of Swiss merchants report being hit by fraud attempts. These statistics paint a stark picture: existing prevention tools are falling short. According to Mastercard, 72% of businesses cite insufficient resources as a key barrier to effective fraud mitigation8. Solutions like Tap on Own Device, which convert high-risk CNP interactions into secure, card-present ones, offer a powerful line of defense in this increasingly hostile landscape.

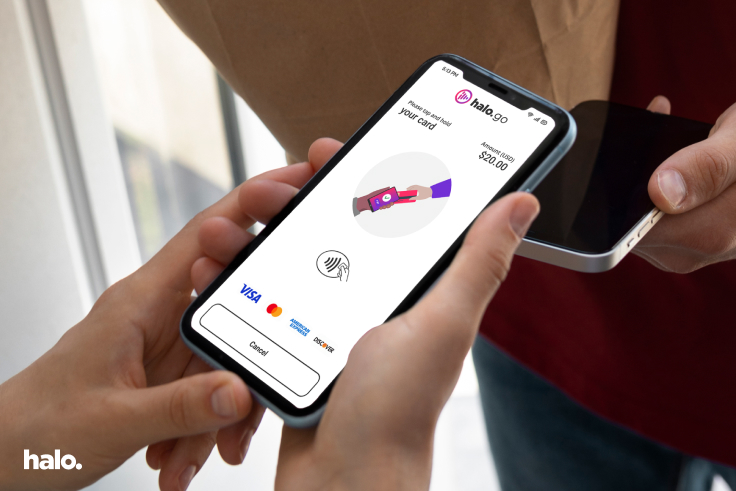

Enter Tap on Own Device

Tap on Own device is an innovative solution that transforms the way that digital payments are conducted. Using NFC technology, consumers can tap their own card or wearable against their NFC-enabled device, shifting a CNP transaction into a CP transaction. This move dramatically reduces fraud risks, enhances security and lowers transactions fees – all while improving the customer’s shopping experience.

Currently being piloted by global payment schemes, Tap on Own Device is not just a future concept; it is already transforming how digital transactions are handled today. Through this pilot, the liability for fraudulent transactions is being shifted to the card issuer3, offering merchants greater protection from fraud.

Tackling the Rising Threat of eCommerce Fraud

The explosion of eCommerce has led to a parallel rise in fraud. A staggering 5x faster growth rate in eCommerce fraud than in sales is placing significant pressure on businesses4. Regions like Asia, North America, Europe and LATAM have all seen notable increases in fraudulent activity. For example, the UK saw a 40% increase in online fraud in 2023 alone5. With fraudulent charges, chargebacks and reputational risks piling up, businesses need stronger tools to safeguard their operations.

Tap on Own Device provides a cutting-edge response to this growing challenge. By eliminating the need for manual entry of card details and reducing the reliance on stored credentials, the technology minimises attack surfaces for fraudsters, offering a more secure, streamlined alternative to traditional card not present transactions.

Benefits of Tap on Own Device

For Consumers:

- No Manual Entry: Consumers complete transactions seamlessly without manually entering card details, significantly reducing errors and fraud.

- No Stored Credentials: With no need to store sensitive information, the risk of credential theft is mitigated

- Convenience and Flexibility: Consumers can use their card or wearable device for payments, making the entire process more flexible and user-friendly.

For Merchants:

- Liability Shift: The liability for fraudulent transactions is shifted away from merchants to issuers3, significantly reducing financial risks.

- Reduced Transaction Fees: By converting CNP transactions in CP transactions, businesses can benefit from lower transactions costs, which are typically associated with higher-risk CNP payments.

- Enhanced Fraud Prevention: The added layers of security that come with Tap on Own Device reduce the likelihood of fraud, offering merchants greater peace of mind.

Use Cases for Tap on Own Device

Tap on Own Device opens a range of possibilities for both consumers and merchants alike. While the schemes may differ on terminology, the overarching principals are as follows:

- Tap to Pay: Allows consumers to tap their card or wearable on their device to complete secure eCommerce purchases, reducing both fraud and fees while increasing consumer convenience.

- Tap to Add: Enables secure and fast saving of payment details for future purchases, enhancing both security and convenience.

- Tap to Verify: Provides an extra layer of security during deliveries by confirming identity through the tap of a card on the recipients own device, reducing fraud in the supply chain

- Tap to Provision: Streamlines the process of adding a card to a digital wallet, ensuring secure, fast and frictionless wallet provisioning

- Tap to Activate: Simplifies card activation, confirming that the recipient is indeed the correct cardholder, thus securing the activation process.

The Road Ahead: Fraud Prevention Under Pilot Schemes

As Tap on Own Device continues to roll out under pilot programs led by global payment schemes, it is already proving to be a powerful tool in the fight against digital payment fraud. One of its most significant benefits lies in the liability shift from merchants to issuers, which offers businesses critical protection from financial loss3. This shift is especially important at a time when fraud is accelerating at an alarming rate – growing five times faster than eCommerce sales4.

For businesses, the cost of fraud isn’t limited to chargebacks and lost revenue. It includes reputational damage, customer trust erosion and operational overhead in managing risk. This is why 70% of merchants now rank fraud as their top pain point in digital commerce6. Meanwhile analysts estimate that 1 in every 100 online transactions today is fraudulent, placing increasing strain on both merchants and payment processors7. With Card Not Present fraud projected to exceed $343 billion globally by 20271, solutions that reduce exposure to this transaction type – such as Tap on Own Device – are more critical than ever.

Additionally, as consumers preferences shift toward mobile-first, secure experiences, biometric authentication and tokenized payment methods are becoming the norm. In fact, its predicted that over 80% of mobile payments will use biometric authentication by 20268 – making secure, NFC-based tap solutions like Tap on Own Device not only relevant, but foundational for the future of digital payments.

Tap on Own Device – the Game Changer

The adoption of Tap on Own Device is not just a technological advancement; it’s a strategic move toward a more secure, fraud-resistant digital payment ecosystem. By reducing fraud risk, transaction fees and operational overhead, businesses are better positioned to thrive in an increasingly digital world.

The pilot currently underway, coupled with the endorsement of leading payment schemes, signals a positive shift toward a future where payments are not just easier but safer for everyone. As this solution gains momentum, adopting such innovative technologies will be critical for businesses seeking to stay ahead of fraud while enhancing customer trust.

References

- Juniper Research, Online Payment Fraud to Exceed $343 Billion Globally by 2027, 2023.

- PCI Security Standards Council, Understanding Card Not Present Transactions, 2021.

- Mastercard, Tapping into the Future of Payments, 2025. Link

- Mastercard, eCommerce Fraud is Growing 5x Faster Than Sales, 2024.

- Financial Times, Online Fraud in the UK Rises 40% in a Year, 2023.

- Mastercard, Merchant Pain Points in Digital Commerce, 2024.

- Arkose Labs, 2024 State of Fraud and Abuse Report.

- Mastercard News and Insights, eCommerce Fraud Trends and Statistics Merchants Need to Know in 2024, https://b2b.mastercard.com/news-and-insights/blog/ecommerce-fraud-trends-and-statistics-merchants-need-to-know-in-2024/